February 8, 2023

ESG-Related Risk Factors: Getting More Specific

When it comes to “general” versus “specific” risk factors, the Orrick team of JT Ho, Carolyn Frantz, Bobby Bee and Hayden Goudy share a reminder that “specific” is better.

In addition to the growing number of ESG-related risk factors, we’ve seen an increase in the number of ESG-related risks specific to the reporting company’s business, rather than “general” or “other” risks. The increase in specific ESG-related risk factors is consistent with guidance from 2019 in which the Securities and Exchange Commission (“SEC”) “eschewed ‘boiler plate’ risk factors that are not tailored to the unique circumstances of each registrant.” See below for an example ESG-related risk factor specific to the reporting company’s business compared with an example ‘general’ ESG-related risk.

Example Specific Risk Factor

Costs of Compliance with Environmental Laws are Significant, and the Cost of Compliance with New Environmental Laws, Including Limitations on GHG Emissions Related to Climate Change, Could Adversely Affect Cash Flows and Financial Condition

Our operations are subject to extensive federal, state and local environmental statutes, rules and regulations. Compliance with these legal requirements requires us to incur costs for, among other things, installation and operation of pollution control equipment, emissions monitoring and fees, remediation and permitting at our facilities. These expenditures have been significant in the past and may increase in the future. We may be forced to shut down other facilities or change their operating status, either temporarily or permanently, if we are unable to comply with these or other existing or new environmental requirements, or if the expenditures required to comply with such requirements are unreasonable.

Compare that to a “general” ESG risk factor:

Example General Risk Factor

Catastrophic events may disrupt our business which could have a material adverse effect on our business, financial condition, and results of operations.

Our business, financial condition, results of operations, access to capital markets and borrowing costs may be adversely affected by a major natural disaster or catastrophic event, including civil unrest, geopolitical instability, war, terrorist attack, the effects of climate change, or pandemics or other public health emergencies such as the recent COVID-19 outbreak, and measures taken in response thereto. In the event of a major disaster or event impacting any of our locations, we may be unable to continue our operations and may endure system interruptions, reputational harm, delays in our application development, lengthy interruptions in our services, breaches of data security and loss of critical data, all of which could have a material adverse effect on our business, financial condition, and results of operations.

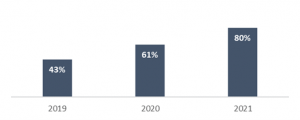

To estimate the increase in the specificity of ESG-related risk factors, we reviewed the headings used to categorize each risk factor in the annual report and assumed that risk factors in the “General” or “Other” category were non-specific, while risk factors that were in other categories (such as “Legal and Regulatory Risks” or “Market and Industry Risks”) were specific to the reporting company’s business. This assumption is not true in every case, but we believe it is a good proxy. Following this methodology, for fiscal year 2019, 43% of the S&P 500 had a specific ESG-related risk factor, which increased to 80% for fiscal year 2021. This chart shows the percentage of the S&P 500 with a specific ESG-Related Risk Factor in the annual report (by fiscal year):

– Liz Dunshee

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL