February 8, 2023

Categories of Climate-Related Risk Factors: Data By Industry

Rounding out the intel on ESG-related risk factors, the Orrick team of JT Ho, Carolyn Frantz, Bobby Bee and Hayden Goudy break down the variety of climate-related risk factors that are appearing in S&P 500 disclosures:

Climate-related risks accounted for most ESG-related risk factors in the S&P 500, with a significant increase in the number of companies reporting climate related risks since 2019. 82% of companies in the S&P 500 reported climate-related risks in fiscal year 2021, compared to just 45% for fiscal year 2019. For the 20% of companies in the S&P 500 which have already filed an annual report for fiscal year 2022, 85% had climate-related risk factors.

Most climate-related risk factors were specific to the reporting company’s business. The most common type of climate-related risks reported for fiscal year 2021 were physical risks related to business operations, with 45% of companies identifying operational risks including potential disruptions in the supply chain due to climate related events and the direct exposure of company assets and operations to more severe hurricanes and wildfires. 15% of the S&P 500 disclosed climate-related legal and regulatory risks for fiscal year 2021. We expect this percentage to increase for fiscal year 2022 given the SEC’s proposed climate-related disclosure rules (the “Proposed Rules”) which are expected to be finalized this year, and the European Union’s Corporate Sustainability Reporting Directive (the “CSRD”), which went into effect this year. Companies should engage with counsel to understand how the Proposed Rules and CSRD may affect their reporting practices and risk-related disclosures.

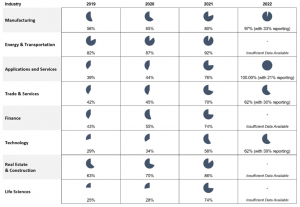

Climate-related risk factors are also becoming more prevalent across industries. For fiscal year 2019, only three industries had more than 50% of their companies report a climate-related risk; energy and transportation (82%), real estate and construction (63%), and manufacturing (56%). By fiscal year 2021, a large majority in every industry across the S&P 500 reported a climate-related risk. Here’s the percentage of the S&P 500 (by industry) with a specific Climate-Related Risk Factor in the annual report (by fiscal year):

Not every company will have ESG- or climate-related risk factors. But regardless of your industry, if you do not have a process in place to identify material company-specific ESG-related risks, especially climate-related risks, there is a potential that your risk management processes and disclosures will fall behind market practices.

– Liz Dunshee

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL