February 8, 2023

ESG-Related Risk Factors: Nearly All S&P 500 Co’s Now Have Them

For those who are still refining their risk factors for this year’s Form 10-K, I’m happy to share this guest post from Orrick’s JT Ho, Carolyn Frantz, Bobby Bee and Hayden Goudy:

For companies with a fiscal year end on December 31, the drafting and review process for the annual report is well underway. Companies, however, should make sure they are considering emerging practices for disclosing environmental-, social-, and governance- (“ESG”) related risk factors.

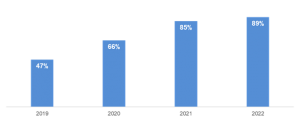

Based on our review of companies in the S&P 500, having ESG-related disclosures in the risk factors is now a common practice. For companies which have already filed their annual report for fiscal year 2022, 89% had ESG-related risk factors. These risk factors spanned a range of ESG-related topics, primarily related to climate change, but also including diversity-, other environmental-, or general ESG-related risks. This graph shows the percentage of the S&P 500 with an ESG-Related Risk Factor in the annual report (by fiscal year):

As you can see, the number of companies with an ESG-related risk factor has increased year-over-year. Less than half of the S&P 500 had an ESG-related risk factor in their annual report for fiscal year 2019. Since then, a significant number of companies have added ESG-related risk factors to their annual report, and we expect this trend to be followed by small- and mid-cap companies.

– Liz Dunshee

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL