January 12, 2021

Board Self-Evaluations: Factoring 2020 Into the Equation

The calendar says it’s 2021, but the distressing events in Washington last week suggest that the 2020 dumpster fire continues to rage on unabated. This Bryan Cave blog says that as much as we’d all like to put 2020 in the rear-view mirror, boards should factor the year’s lessons into the topics they discuss during upcoming board evaluations. Here are some suggested supplemental discussion topics prepared with the annus horribilis in mind:

– All board members have sufficient technology capabilities, IT infrastructure and cybersecurity protections to effectively access board materials, prepare for and participate in board meetings in the virtual environment.

– Board members pay sufficient attention to environmental and social consequences and potential risks resulting from the company’s activities.

– Board members are able to clearly and effectively communicate with each other and with management in the virtual environment, enabling them to fulfill their responsibilities and make rapid and significant decisions during the COVID-19 pandemic.

– All board members, regardless of their gender, race or ethnicity, feel that their voices are heard and their contributions are respected and valued.

The blog suggests several additional topics for consideration in the self-evaluation process. It says that expanding the process to cover these topics will assist boards in learning from the events of 2020 & in taking appropriate actions to adapt to the pandemic and address the other areas of heightened investor concern that arose last year.

SEC Enforcement: Ripple’s “Takin’ It To The Tweets. . .”

I think the last time I blogged about the fraught relationship between the crypto folks & SEC Enforcement, I reviewed how Kik Interactive got clobbered by a federal judge after it actively courted an enforcement proceeding. Daring the SEC to bring an enforcement action is something that I have a hard time understanding, but then again, I have a hard time understanding quite a few things about the digital asset evangelists.

The latest situation to befuddle me involves Ripple Labs, which recently found itself the target of the customary SEC enforcement action alleging that its $1.3 billion unregistered offering of digital assets violated Section 5 of the Securities Act. Being crypto folks, Ripple’s management went out and did a very crypto thing in response to the SEC’s allegations. Instead of just issuing the standard press release indicating that the company intended to vigorously contest the SEC’s claims, Ripple opted to take to social media, where its CEO Brad Garlinghouse posted a 10 tweet thread addressing “5 key questions” raised by the proceeding. Not to be outdone, Ripple’s GC weighed-in with a brief thread of his own addressing the lawsuit.

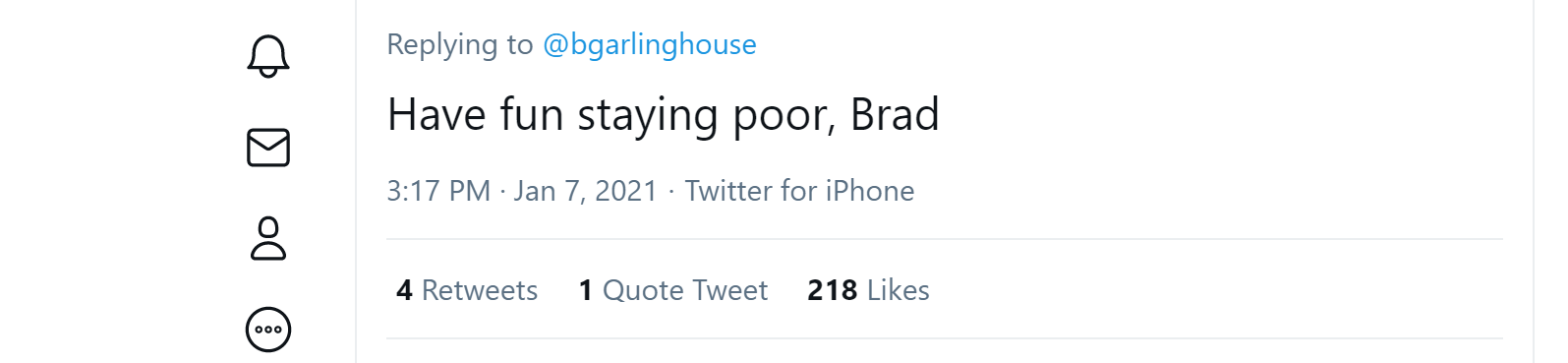

Admittedly, this isn’t functionally all that much different from addressing a major piece of litigation or an SEC enforcement action in an investor call. But one of the benefits of the more traditional approach is that you avoid the baggage that comes along with the “rage as a service” platform known as Twitter – such as being on the receiving end of a grenade like this in your mentions:

Ouch! That’ll leave a mark.

MD&A & Financial Disclosures: Effective Date of the New Rules

One of our members pointed out in our Q&A Forum that the SEC’s amendments to the MD&A and financial disclosure rules were published in the Federal Register on Monday. The rules will be effective February 10, 2021 – and early compliance is permitted for filings made after that date, so long as the company provides disclosure responsive to an amended item in its entirety. However, companies are not required to comply with the new rules until the first fiscal year ending on or after August 9, 2021 (210 days after the Federal Register publication date).

Since the clock is now ticking, be sure to check out today’s webcast on the new rules!

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL