December 22, 2020

Read All About It: Get Our Newsletters Delivered to You Electronically!

With so many of our members working remotely, we wanted to be sure to let our print newsletter subscribers know that The Corporate Counsel and The Corporate Executive are now available electronically! Renew your subscriptions today and select electronic delivery for easier access to the ongoing practical guidance you’ll receive from both of these newsletters during the challenging year ahead. You will receive email notifications each time a new issue is released.

If you wish to sign up multiple users for the electronic newsletters, please contact customer service for pricing and assistance at info@ccrcorp.com or 1-800-737-1271. We will need to make sure we have all of the correct email addresses so we can send out login credentials for each user.

Political Contributions Disclosure: SEC Can’t Spend Funding On Rules

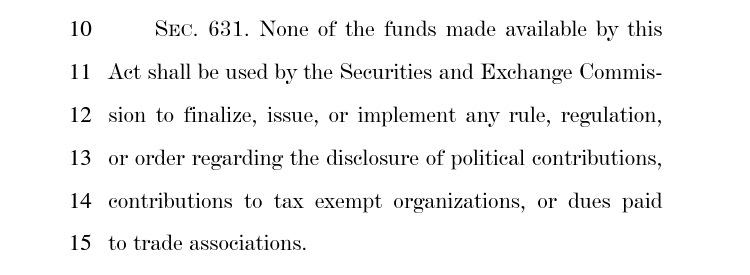

One of our members pointed out to us that the 2021 Consolidated Appropriations Act that Congress passed last night includes the now customary prohibition on the SEC spending any of its funds on rules requiring the disclosure of political contributions. Here it is, in all its glory:

I called this a “now customary” prohibition because Congress has been doing the exact same thing in appropriations bills for several years now. Disclosure of political contributions is a controversial issue, and the decision to ban the SEC from taking any action on it would likely be controversial too – if anybody had time to complain. Congress’s bipartisan willingness to repeatedly bury this kind of decision in one paragraph of 5,000+ page appropriations bills isn’t exactly a “profile in courage.”

November-December Issue of “The Corporate Executive”

The November-December issue of The Corporate Executive was just posted – & also sent to the printer. It’s available now to members of TheCorporateCounsel.net who also subscribe to the electronic newsletter (try a no-risk trial). This issue includes articles on:

– Tax Withholding Deposits for Stock Plan Transactions—Understanding the New Relief

– Some Deferred Compensation Plans and Employment or Stock Award Agreements May Need to be Amended by December 31, 2020

– SEC Proposes Amendments to Rule 701 and Form S-8

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL