June 17, 2024

AI-Related Disclosures in SEC Filings: Trends from the S&P 500 (Part 1)

Al disclosure is a topic that’s getting a lot of attention from investors and a lot of scrutiny from the SEC. That’s why we pleased to bring you this week a series of three guest blogs on AI disclosure practices among the S&P 500 by Orrick’s J.T. Ho, Bobby Bee and Hayden Goudy:

The growth of generative artificial intelligence (AI) is transforming business, sparking a rise in public company disclosure and considerable investor interest. A growing number of companies are disclosing AI capabilities, opportunities and risks in filings with the Securities and Exchange Commission (SEC). At the same time, the SEC has demonstrated its commitment to combat “AI washing” – the practice of overstating or falsifying AI usage – with enforcement actions against several investment advisors signaling the start of a broader effort to police AI-related disclosures.

Activist investors are also interested in AI-related risks. Several shareholder proposals requesting disclosure of AI-related oversight have received high levels of support at recent annual shareholder meetings.

Our review of SEC filings from the S&P 500 for the 12 months ending April 30, 2024, paints the portrait of an evolving landscape when it comes to AI-related disclosures. It reveals trends in:

– Emerging investor expectations

– Activist investor interests

– Corporate disclosures

(Including in proxy statements and in the “Risk Factors,” “Business” and “Management Discussion and Analysis” (MD&A) sections of annual reports on Form 10-K)

What Public Companies Should Consider Doing Now

Relevant disclosure is not only appropriate but often necessary when AI becomes a material aspect of a company’s business. Investors and market regulators expect transparency, effective governance oversight and effective risk management over the numerous ways that companies are developing and deploying AI. Misrepresenting AI capabilities and failing to properly oversee risks could severely damage investor trust and lead to lawsuits and regulatory action.

Where AI has a significant impact on the business, public companies should:

– Validate AI statements and develop effective disclosure controls and procedures to support the accuracy of public AI-related disclosures.

– Develop governance structures to identify and manage AI-related risks at both the board and management level, and disclose both significant AI-related risks and oversight of those risks in required SEC disclosures.

A Closer Look at Investor Activity and Corporate Disclosure Trends

In the sections that follow, we examine AI-related disclosure trends in SEC filings across the S&P 500. We also explore the expectations of proxy advisors and activist investors, share data on increasing references to AI in annual reports on Form 10-K and highlight a potential gap in proxy statement disclosures regarding AI oversight.

Emerging Investor Expectations

While AI is an emerging priority for many investors, institutional asset managers and proxy advisors generally have not established formal guidelines regarding oversight of AI by the board or its committees.

Several major investors have identified AI as a significant opportunity for their investment activities, but most U.S.-based investors have not articulated specific expectations for oversight and management of AI by public companies.

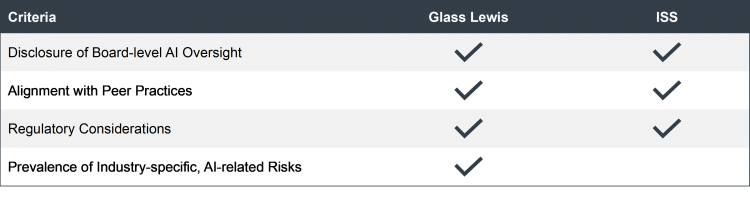

The proxy advisors Glass Lewis and ISS have identified AI as a relevant area for future policy development, but currently approach AI-related matters on a case-by-case basis. For the limited number of AI-related shareholder proposals voted on to date, Glass Lewis and ISS generally consider the following criteria when making recommendations:

Activist Investor Interests

Activist investors are also interested in AI-related issues.

We identified 13 shareholder proposals related to AI submitted in the 2024 proxy season. These proposals ask for disclosure on topics including the use of AI in company product and operations, the role of the board in overseeing AI and the prevalence of AI-related risks. Several AI-related proposals have received the support of 20 percent or more of votes cast at an annual shareholder meeting.

We expect AI-related shareholder proposals to continue to be an agenda item for activist investors, especially for companies that experience AI-related controversies or have business models at risk due to the potential impact of AI.

Be sure to check out the next installment of this three-part series, which will focus on AI-related risk factor disclosures.

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL