June 20, 2024

AI-Related Disclosures in SEC Filings: Trends from the S&P 500 (Part 3)

Here’s the final installment in our series of guest blogs on AI Related Disclosures by Orrick’s J.T. Ho, Bobby Bee and Hayden Goudy:

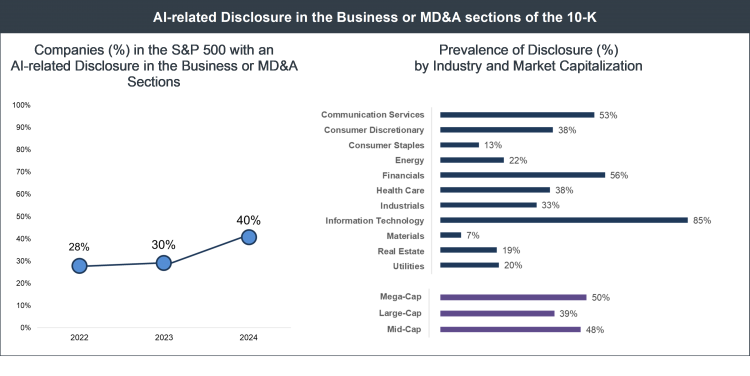

AI-related Business and MD&A Disclosure. Several companies in the S&P 500 mentioned AI in the Business or MD&A sections of their most recent 10-K, tying AI to their main products and services or to key business updates. While less common than an AI-related risk factor, 40% of the S&P 500 had an AI-related disclosure in the Business or MD&A sections of their most recent 10-K, an increase from 30% in the previous period.

AI-related disclosure in the Business or MD&A sections of the 10-K varied significantly by industry. For instance, 85% of companies in the information technology sector made an AI-disclosure in the Business or MD&A sections, compared to 56% of companies in the financial sector and 38% of companies in health care.

As more companies adopt AI in their operations, products and services, we expect more references to AI in the Business and MD&A sections of 10-Ks across the S&P 500.

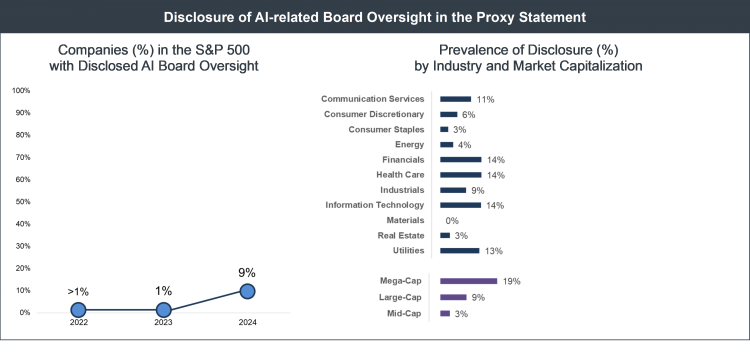

Limited Disclosure in the Proxy Statement. AI-related disclosure in the proxy statement across the S&P 500 was limited. While more than 39% of companies in the S&P 500 mentioned AI in their most recent proxy statement, a significant proportion of references were to new AI-related products or the role that AI was playing as part of a business transformation. Additionally, 24% of the S&P 500 disclosed director-level AI-related expertise or experience in their most recent proxy statement.

However, a much smaller percentage of companies in the S&P 500, approximately 9%, disclosed the role of the board or its committees in overseeing AI-related risks.

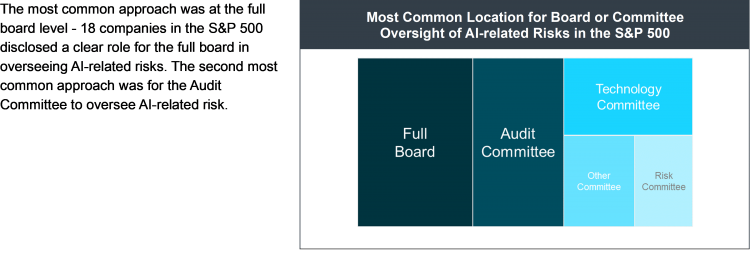

For companies that disclosed board or committee oversight, the allocation of that responsibility varied.

The most common approach was at the full board level – 18 companies in the S&P 500 disclosed a clear role for the full board in overseeing AI-related risks. The second most common approach was for the Audit Committee to oversee AI-related risk.

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL