June 18, 2024

AI-Related Disclosures in SEC Filings: Trends from the S&P 500 (Part 2)

Here’s the second installment in our series of three guest blogs on AI Related Disclosures by Orrick’s J.T. Ho, Bobby Bee and Hayden Goudy:

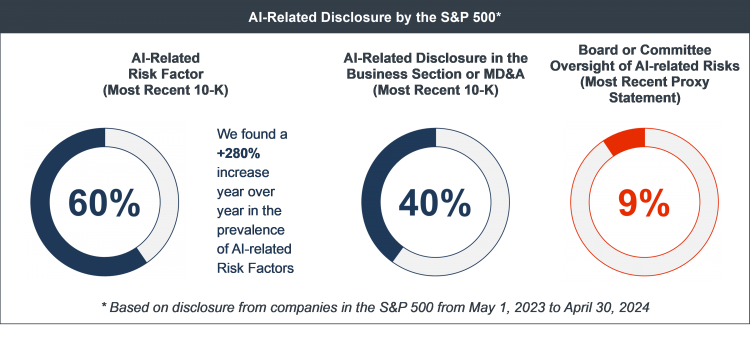

Corporate Disclosure Trends We identified AI as one of the fastest growing disclosure topics in SEC filings across the S&P 500, with a rapidly growing number of companies disclosing AI-related risk factors in the 10 K. However, disclosure of AI-related oversight at the board and management level in the proxy statement significantly lagged disclosure of AI-related risks in the 10-K.

Companies Disclosed AI-Related Risks More Often Than AI Oversight. We found a gap between the prevalence with which companies in the S&P 500 disclosed significant or material AI-related risks and the prevalence with which they disclosed board and committee oversight of those risks in the proxy statement. Together with growing investor and activist interest, we expect increasing pressure from a range of stakeholders on public companies to address this gap, including pressure to develop and disclose an approach to AI oversight at the board or committee level.

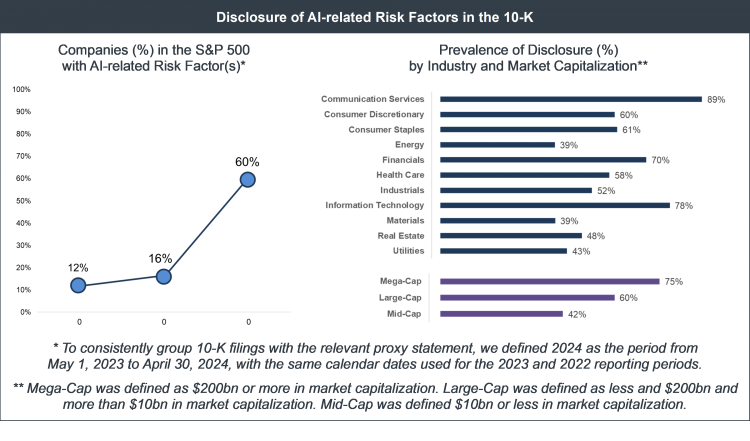

AI-related Risk Factors.The most common type of AI-related disclosure in SEC filings across the S&P 500 was an AI-related risk factor. Nearly 60% of the S&P 500 disclosed an AI-related risk factor in their most recent 10-K. This was a major increase from the previous reporting period, where only 16% of the S&P 500 disclosed an AI-related risk factor.

Most relevant risk factors in the S&P 500 were not focused solely on AI. Instead, we found that references to AI were generally integrated into existing risk factors. Companies included AI-related references into risk factors addressing:

– Cybersecurity risks, such as higher levels of exposure due to threat actors using AI, or a higher likelihood of a data breach due to the use of AI tools.

– Operational and business risks, such as higher costs from adopting AI technology or potential loss of market share from AI-driven disruption.

– Potential harm to the company brand and reputation from intellectual property disputes involving AI.

– Costs or risks associated with AI regulations.

The final installment of this series will address AI-related Business and MD&A disclosure, as well as practices regarding AI-disclosures in proxy materials.

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL