August 8, 2018

“To Reg FD & Beyond!” Elon Musk’s Tesla Tweetstorm

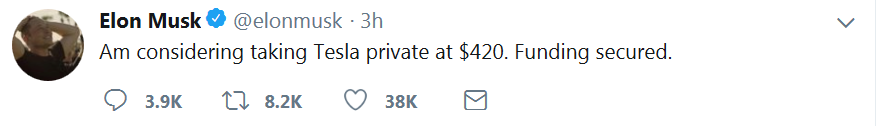

So, Elon Musk arrived at work yesterday and decided to tweet this:

Utter chaos then ensued. More tweets followed, Tesla’s stock soared, shorts got squeezed, Nasdaq halted trading, Tesla blogged more details, and the stock began trading again & closed up 11% on the day. Meanwhile, people began to chatter about whether Musk violated Reg FD – or whether he might face bigger legal woes.

The Reg FD issue is an interesting one. Over on “Broc Tales,” Broc had a great blog a while back about the perils of CEO social media accounts & the potential need for a “Twitter baby-sitter.” Mindful of the Netflix 21(a) report, I took a quick look at Tesla’s investor page & didn’t notice anything indicating that Elon’s twitter feed would be a channel of investor information – but that’s because it happened so long ago, in a 2013 Form 8-K (hat tip to this MarketWatch article). Tesla did this in November 2013, the tail end of when a slew of companies filed this type of 8-K in the wake of the SEC’s latest social media guidance (companies seem to have stopped filing those 8-Ks, but that’s for another blog). So, maybe there’s an issue – or maybe there’s not?

Elon Musk has 22 million followers & has been using his Twitter account to share info with investors for years, so it seems like a stretch to say that his tweets aren’t a “recognized channel” for Tesla information by now – particularly given that Tesla 8-K’ed about it five years ago. He’s practically. . . umm – is “presidential” the right word? – in his use of social media to get information out, so while I doubt Elon cares much about Reg FD, my initial impression is that he’s got a decent argument that he hasn’t run afoul of it.

In any case, Reg FD just might turn out to be the least of Elon’s problems when it comes to his unconventional approach to disclosure. As Prof. John Coffee noted in this “Yahoo! Finance” article, Musk may face some exposure if he fudged about the financing:

If Musk’s aim was to temporarily boost Tesla’s stock in order to force losses on short sellers, it could be considered stock manipulation, which is illegal. “That’s too inviting to a plaintiff’s lawyer not to sue,” says Coffee. “This would be an attractive lawsuit. The people who think he’s manipulating the market would say they’ve suffered an injury, and you could pull all those losses together in a class action.”

If, on the other hand, Musk can demonstrate that he has actually arranged financing for a private buyout, or made serious efforts to do so, he might be off the hook.

It should be very entertaining to watch this whole thing unfold, but there’s one question that I’m just dying to get an answer to – what did Elon’s lawyers do to make him hate them this much? Tesla lawyers, the Excedrin’s on me!

Sustainability: Beware The Golden State, Delaware Virtue Signalers!

A few weeks ago, I blogged about Delaware’s new voluntary sustainability certification regime. The state’s new statute goes to considerable lengths to disclaim any liability for actions that boards & corporations take with respect to it – but this recent blog from Keith Bishop says “not so fast.”

It turns out that those companies that want to hang out Delaware’s gold star for sustainability may find themselves in the cross-hairs in California. Here’s an excerpt:

California has enacted an extremely broad unfair competition law, Bus. & Prof. Code § 17200, that seeks to protect both consumers and competitors from any unlawful, unfair or fraudulent business act or practice. By proscribing unlawful competition, California’s UCL does not enforce the borrowed statute, but treats them as unlawful practices that the UCL makes independently actionable. Cel-Tech Communications, Inc. v. Los Angeles Cellular Telephone Co., 20 Cal. 4th 163, 180 (1999).

When the inevitable UCL suit is filed in California against a Delaware corporation for allegedly false or misleading “virtue signaling” under the Delaware statute, the California courts will face interesting questions of conflict of laws and comity.

Looks like there’s still no such thing as a free lunch.

Succession Planning: Most CEOs Say They Weren’t Ready

CEO succession planning has become an increasingly important issue – and as Broc recently noted, one that’s even made an appearance in pop culture. However, if you measure a company’s succession planning efforts by the readiness of a new CEO to grab the reins, this Harvard Business Review article says that there’s a lot more work to be done.

According to the article, 68% of CEOs say that they weren’t fully ready for their job – and as this excerpt suggests, that’s not the only shortcoming when it comes to succession planning:

This signals that something is missing in internal hiring and development processes, and in board management of CEOs. Indeed, among CEOs who’d risen in the ranks through their firms, only 28% told us they’d been adequately prepared for the top job, and among all respondents, only 38% said they turned to their board chairman for honest feedback, while only 28% sought counsel from non-chairmen directors.

Egads! That’s practically the definition of a dysfunctional process.

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL