September 1, 2017

UK Proposes Broad Governance Reform: Includes Pay Ratio & “Names & Shames” List

A few days ago, the United Kingdom proposed specific reforms as reflected in this 68-page response to its “Green Paper.” The reforms proposed relate to three specific areas: Executive pay, strengthening the employee, customer and supplier voice and corporate governance in large privately held businesses.

The proposal waters down some of the more controversial aspects of the Green Paper (eg. binding say-on-pay votes) – but the remaining proposals are quite astounding. Here’s the ones relating to executive pay:

1. Require listed companies to report pay-ratio information annually (the ratio of CEO pay to the average pay of the company’s UK workforce), including a narrative explaining changes to the ratio from year to year and “setting the ratio in the context of pay and conditions across the wider workforce.”

2. Provide a “clearer explanation in remuneration policies of a range of potential outcomes from complex, share-based incentive schemes.”

3. Provide specific steps listed companies should take when there is significant shareholder opposition to executive pay policies and awards (which might include, for example, provisions for companies to respond publicly to dissent within a certain time period, or to verify that dissent has been sufficiently addressed by putting the company’s existing or revised remuneration policy to a shareholder vote at the next annual meeting).

4. Increase the responsibility of comp committees for oversight of pay and incentives across the company and require these committees “to engage with the wider workforce to explain how executive remuneration aligns with wider company pay policy (using pay ratios to help explain the approach where appropriate).”

5. Extend the recommended vesting & post-vesting holding periods for executive equity awards from three to five years to encourage a longer term focus.

6. Invite the Investment Association to maintain a public register of listed companies that receive shareholder opposition of 20% or more on say on pay, along with “a record of what these companies say they are doing to address shareholder concerns.”

This Cooley blog goes into detail to explain the proposed reform – and here’s a NY Times article.

NYSE Proposes to Amend “Material News Policy” Again

Here’s news from this Steve Quinlivan blog:

In 2015 the NYSE amended its policy with respect to material news releases. One of the amendments was to include advisory text in Section 202.06 of the Listed Companies Manual requesting that listed companies intending to release material news after the close of trading on the Exchange wait until the earlier of the publication of their security’s official closing price on the Exchange or fifteen minutes after the scheduled closing time on the Exchange. The reason for the change was that securities trade in other markets after the NYSE closes, and investor confusion arises if the trades in other markets are at prices different than NYSE trades being completed at the NYSE closing price.

Notwithstanding the addition of the advisory text, the NYSE has continued to experience situations where material news released shortly after 4:00 p.m. has caused significant investor confusion. Accordingly, the NYSE now proposes to amend Section 202.06 to prohibit listed companies from issuing material news after the official closing time for the NYSE’s trading session until the earlier of publication of such company’s official closing price on the Exchange or five minutes after the official closing time. The NYSE believes that designated market makers are able to complete the closing auctions for the securities assigned to the market maker in almost all cases within five minutes of the NYSE’s official closing time.

In the proposed rule, the NYSE continues to recommend that companies that intend to issue material news after the NYSE’s official closing time delay doing so until the earlier of publication of such company’s official closing price on the NYSE or fifteen minutes after the Exchange’s official closing time. The foregoing change is in addition to changes to NYSE rules related to dividend announcements, which the NYSE is currently seeking to delay to facilitate implementation of the new rules.

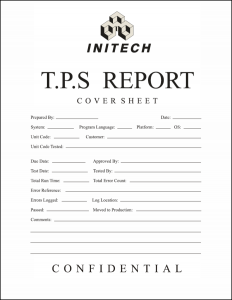

Happy Labor Day! “Office Space” Style

Enjoy the long weekend – assuming you have your TPS Reports done. If not, I think Lumberg wants to see you.

Enjoy the long weekend – assuming you have your TPS Reports done. If not, I think Lumberg wants to see you.

– John Jenkins

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of TheCorporateCounsel.net? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL